Lessons I Learned From Tips About How To Lower My Apr On My Credit Card

It took me about 45 minutes to call or chat with all five of the credit card issuers:

How to lower my apr on my credit card. Treat your credit card like a debit card. Only use your credit card for a purchase that you can already afford to pay for in full. These cards offer 0% apr introductory offers for a.

You may also want to consider enlisting the help of a nonprofit credit counselor who can help you go over your financial situation and give you some advice for requesting a. Your credit card company most. From his experience, credit card companies seem more willing to offer lower rates when you ask after making consistent payments on your card for at least six months.

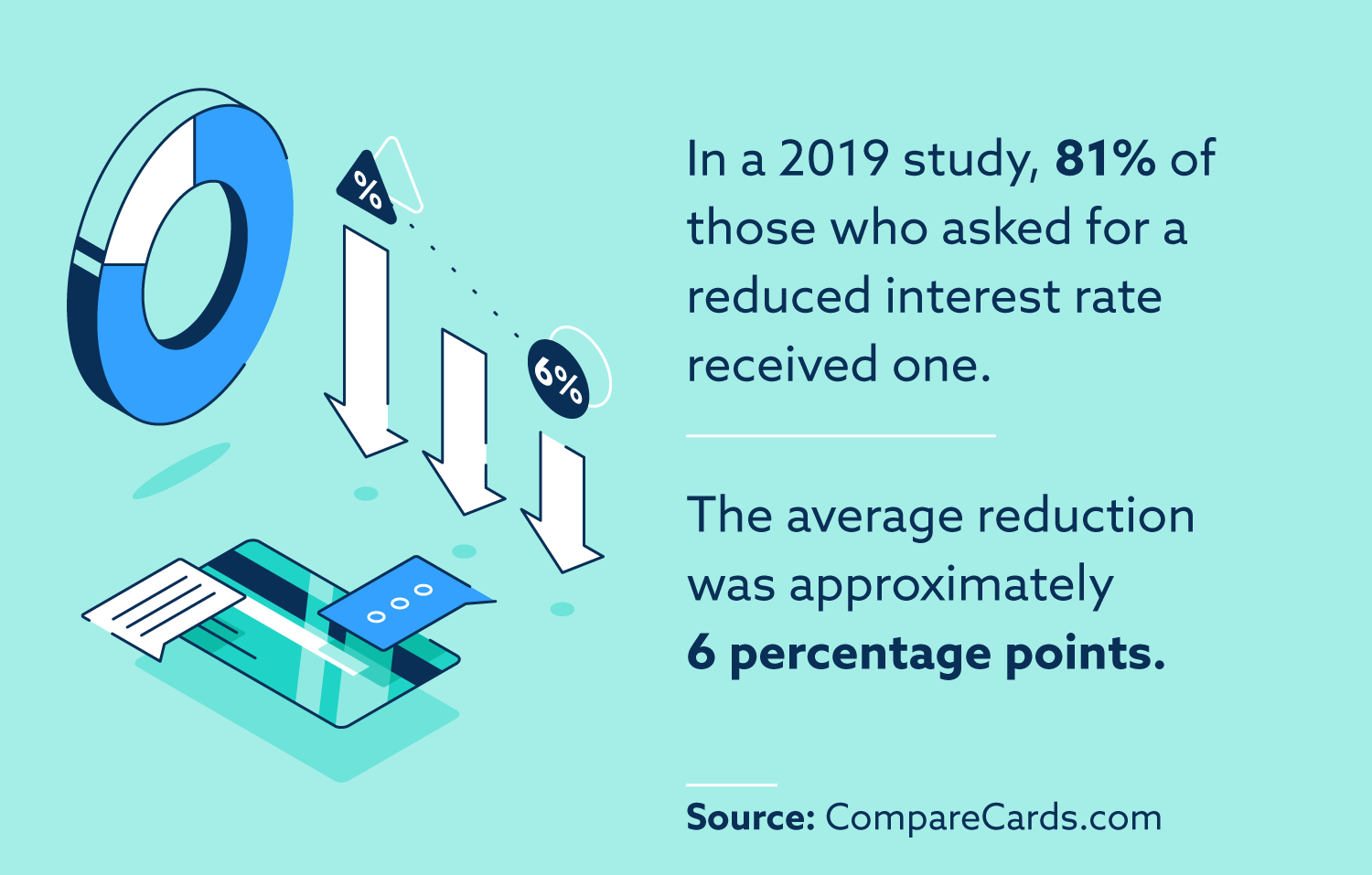

Yes, part of the secret to a lower credit card apr is asking, but the bigger secret is persistence. So a credit card might have an interest rate of 10%+ prime, giving you a rate of 13.25%. Improve your credit score an improvement in your credit score is critical if you want to start reducing the apr you're being offered by lenders on credit card applications.

American express, chase, citi, discover and wells fargo. First, assess your own situation and have a goal for. However, be prepared for the representative’s.

You need to talk with someone who can lower your apr and waive the annual fee. Ask them to transfer the call to a supervisor. Contact your credit card issuer and explain why you would like an interest rate.

Your credit card company won't lower your apr just because you've been taking care of your credit; In turn, this can make it easier and faster to pay off. The best way to lower the interest rate on a capital one credit card is to transfer the balance to a 0% apr card from a different credit card company.