Sensational Tips About How To Avoid Credit Card Interest

How to avoid paying deferred interest.

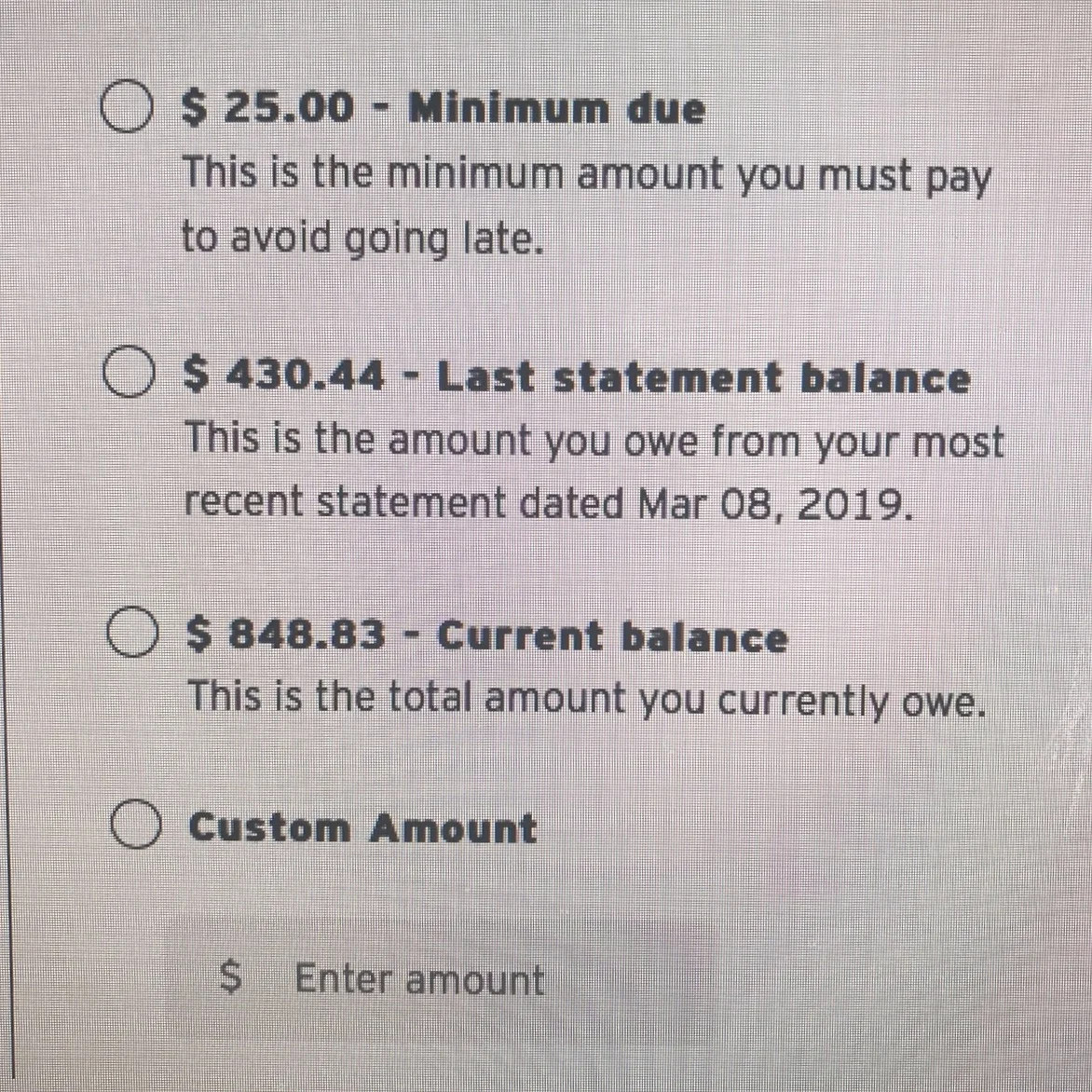

How to avoid credit card interest. The easiest way to avoid credit card interest charges is if you make timely payments every month, so you won’t be charged any interest on your transactions. The only way to eliminate credit card interest entirely is to pay your balance in full every month. If you’re on a hunt to learn how to avoid credit card interest, one of the easiest ways to do this is by paying off the credit card balance in full, each month.

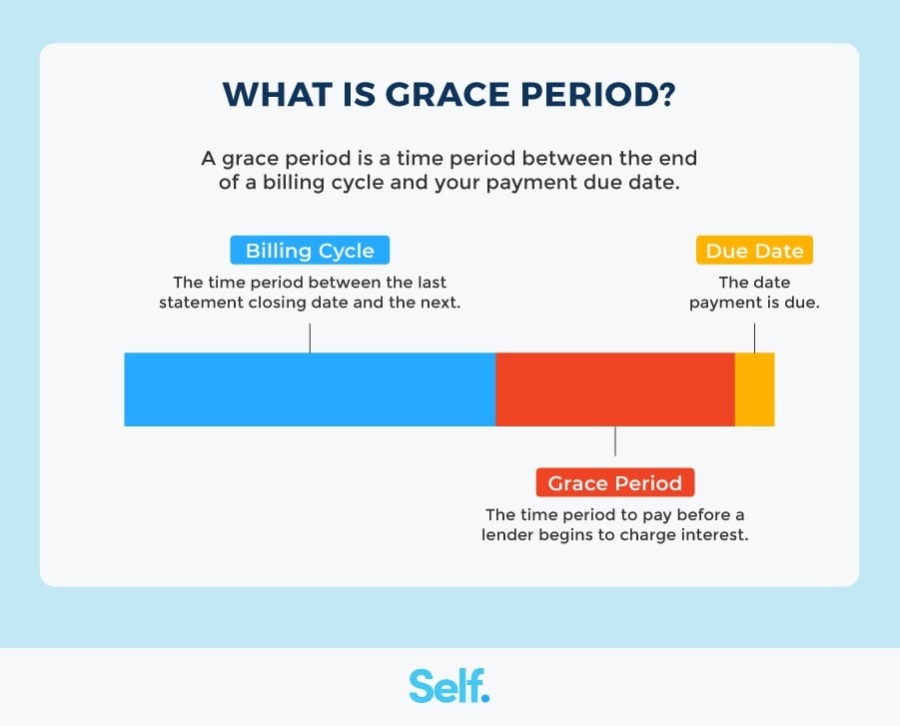

It’s common for intro apr periods to range from. Generally, you can avoid credit card interest by paying your balance in full every month before the end of the grace period. For credit card accounts that.

The best way to avoid paying. — paying your bill in full. Having a credit card doesn't necessarily mean you need to pay interest.

You can do this by: How to avoid paying interest on a credit card. Another way to avoid being charged credit card interest is by applying for a card offering an introductory 0% intro apr period.

They say that since rent is a fixed expense and not a sudden expense, it should be a part of the. Card issuers typically extend a grace period to allow you to avoid interest by paying on time, but this. But there are also ways to reduce your interest costs significantly as you pay.

Interest is typically shown as an annual percentage rate, or apr. 1.2 treat your credit card like a debit card; Lenders and credit card issuers have different ways of calculating interest fees, and the process can get complicated.

:max_bytes(150000):strip_icc()/Understandingcreditcardinterestrates-34225cda88fd454a8b690e5252b71cb8.jpg)