Awesome Info About How To Avoid Cibil

Not only will this give you breathing space but it will also reduce your emis significantly.

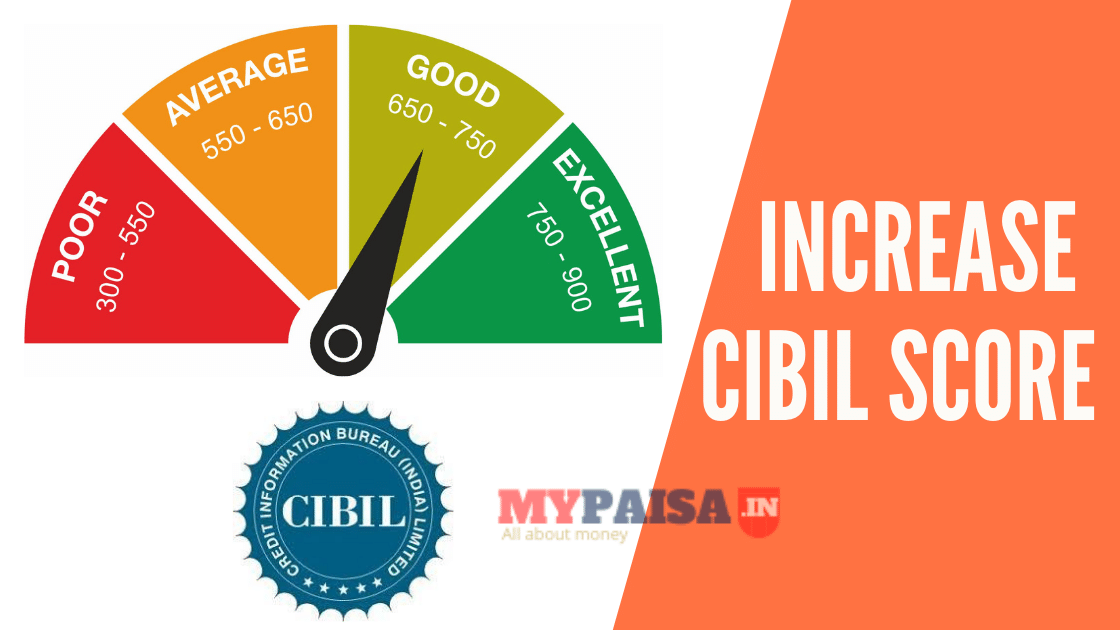

How to avoid cibil. When you combine the maximum limit of multiple credit cards, it may show that. There could be few accounts. Once the cibil dispute form is submitted, transunion cibil will verify the information.

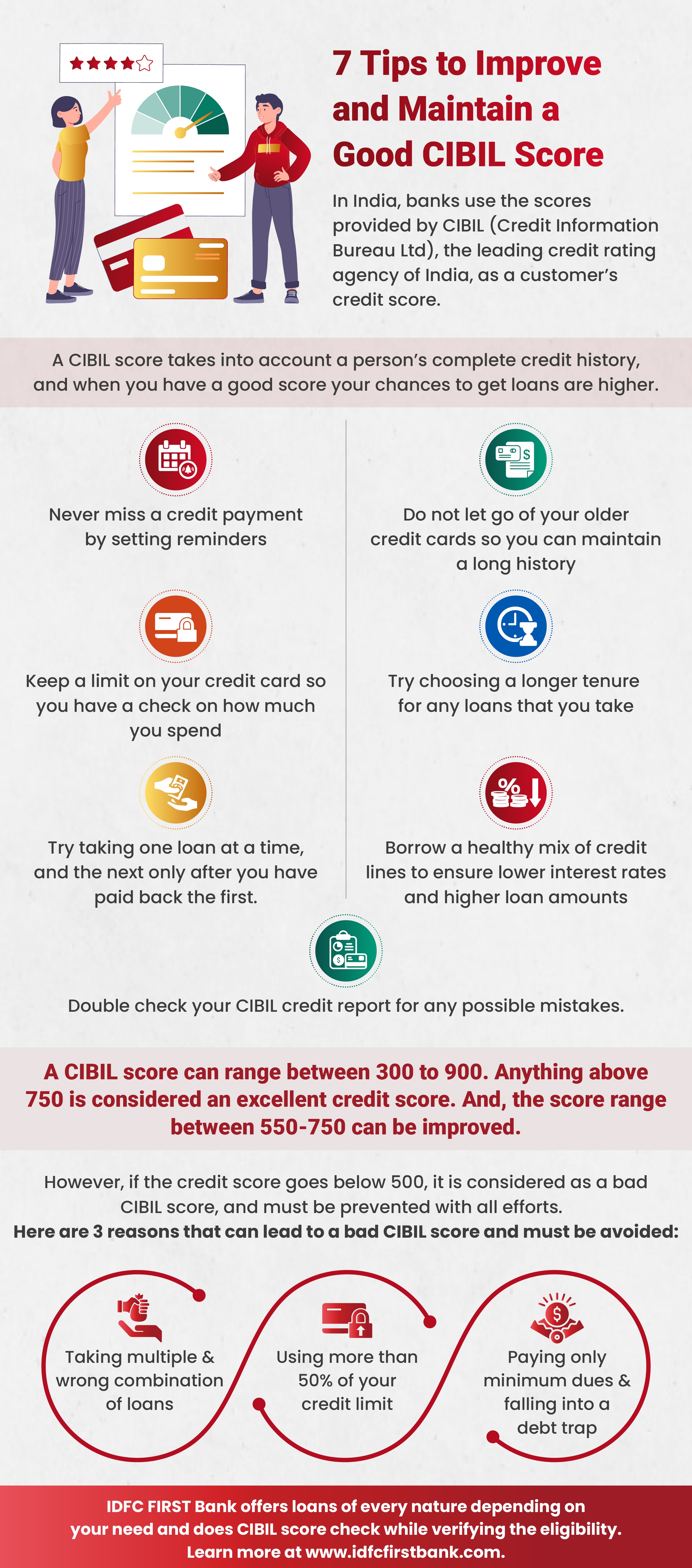

It’s always advisable to avoid taking too many credit cards. The best way to avoid this is by setting monthly reminders to automatically pay the due amount before the given due date. Not paying bills on time.

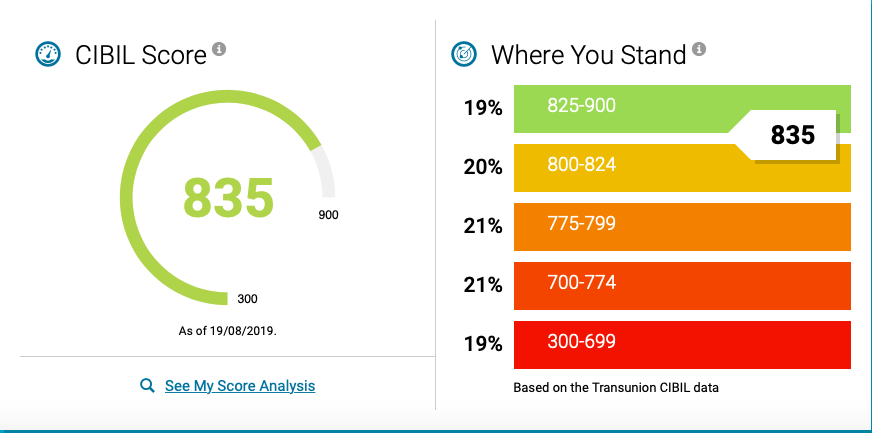

Always be prudent to not use too much credit, control your utilization. Follow this article if you want to know how to check cibil score and learn effective ways to maintain a good credit history. Check the payment history of every account.

You should also avoid utilising the maximum credit limit on your credit cards lenders tend to approve loans if. Cibil forms the same impression about you if you simultaneously apply for too many credit cards. Be judicious when you apply.

Check if there is any account which has been tagged incorrectly. If yes, raise a dispute via cibil’s dispute resolution process. Another option is to set reminders and verify that everything is in order before the payable dates.

Here are some steps you can take to stay a step ahead of fraudsters, avoid being a victim of credit fraud, and protect your online identity: You cannot delete loan enquiries in cibil. Maintain a healthy credit mix: